What does your state charge to plate your C7?

#41

Melting Slicks

The way that I interpreted the OP's question (perhaps incorrectly) is what is the cost (registration, property tax if applicable, smog, etc. not including gas/repairs) to drive your C7 on public roads in your state.

From the responses, the costs range from ~$50/yr to $1,600'ish/year

From the responses, the costs range from ~$50/yr to $1,600'ish/year

#43

Pro

Member Since: Jul 2016

Location: N. San Diego-Fallbrook California

Posts: 698

Received 191 Likes

on

152 Posts

Another one here from CA, It was around $700+, my renewal (one year old car) was $635. Due to our governor CA has added $125 DMV tax starting in 2018, so next year it may be back to $700.

The following users liked this post:

ImpliedConsent (02-07-2018)

#45

Racer

Oregon - $270.00 for four years and we don't have sales tax.

#46

Burning Brakes

In KY, if new, your 6% sales tax covers everything but a $21 registration fee. Then in succeeding years, in order to renew your plate decal, you pay a $21 registration fee on the vehicle, and a personal property tax based on 95% (I believe) of the book value of the vehicle. You must also show proof of insurance at the time of renewal. A Vette can easily cost $400 to 500 dollars. The personal property tax is the responsibility of whoever is the registered owner on the first day of each year. So if you own a vehicle on 1 January and sell it on 2 January you will still owe the state the property tax. If you take ownership on 2 January and sell by 31 December of each year, in theory all you would ever pay is $21 per vehicle.

#47

Le Mans Master

Member Since: Jan 2006

Location: Down south in Dixie

Posts: 6,801

Received 2,639 Likes

on

1,702 Posts

Tag, and title in North Carolina is approx. 85 bucks. You have to watch some dealers as they will pad that price for more profit. We pay our property tax when we renew the registration (tag).

Last edited by Rebel Yell; 02-07-2018 at 01:11 PM.

#48

Advanced

In Minnesota we have a Village Idiot for Governor and My 17 C7 cost $842 for the first year plates My 2013 Avalanche Tabs are $242 and the Daily drive 2007 Tahoe is the winner $45 per year

#49

In VA, we have personal property taxes. For my first year, I'll pay over $1400.00 in personal property taxes for a '17 1LT Z51. Yeah. I think my tax envelope is just going to have a big red stamp on it that says "bend over".

#51

Safety Car

Member Since: Feb 2016

Location: Bainbridge Island WA

Posts: 4,980

Received 3,818 Likes

on

1,614 Posts

Although these tables look definitive, I wouldn't take them as gospel. The property tax percentage for WA is listed as 2.71% when in reality it's more like 1.5%. Since they don't show their work I can't tell how they arrived at their figures.

I'm also not convinced that there "aren't a lot of differences." California is a very high-tax state. Is your quality of life better there? I realize they get a lot of sun, but that's not a government-provided service and is also offset by the burden of living in high population areas like the LA basin. Besides, Florida is a low tax state and gives you plenty of sun. So what does California provide to justify its high taxes?

The following users liked this post:

NavyBlue2 (02-07-2018)

#52

Burning Brakes

Looking on the bright side, it should be a bit less going forward in subsequent years due to the vehicle’s diminishing value. Unless of course the tax rate goes up.

Last edited by Squeaky Wheel; 02-07-2018 at 01:43 PM.

#53

Burning Brakes

Member Since: Jan 2014

Location: Colorado Springs, CO/Augusta,GA Colorado

Posts: 1,178

Received 211 Likes

on

157 Posts

I did post but I am a disabled veteran, so mine cost nothing to plate...the 8.25% sales tax still applies. For those that have to pay the full cost to title, generally it is about 85% of MSRP. There are two ways that it can be computed for vehicles 2016 or newer for first time registration. I will include both examples:

Taxable Value (85% of MSRP) = $90,000.00

multiplied by Year of Vehicle Rate = .021

plus the estimated cost by Type of Vehicle = $93.00

ESTIMATED TOTAL = $1,983.00

This is an estimate. Actual cost will vary. Other fees due (such as late fees) are not included in this estimate. Do not write out a check for this amount!

Taxable Value (85% of MSRP) = $76,500.00

multiplied by Year of Vehicle Rate = .021

plus the estimated cost by Type of Vehicle = $93.00

ESTIMATED TOTAL = $1,699.50

This is an estimate. Actual cost will vary. Other fees due (such as late fees) are not included in this estimate. Do not write out a check for this amount!

The yearly tag/registration renewal is based on a sliding scale but based on value of car.

Sales tax is 8.25% of total cost of vehicle to be collected before or at same time of initial registration.

Yep pretty darn expensive.....especially considering the yearly renewal is not cheap.

Taxable Value (85% of MSRP) = $90,000.00

multiplied by Year of Vehicle Rate = .021

plus the estimated cost by Type of Vehicle = $93.00

ESTIMATED TOTAL = $1,983.00

This is an estimate. Actual cost will vary. Other fees due (such as late fees) are not included in this estimate. Do not write out a check for this amount!

Taxable Value (85% of MSRP) = $76,500.00

multiplied by Year of Vehicle Rate = .021

plus the estimated cost by Type of Vehicle = $93.00

ESTIMATED TOTAL = $1,699.50

This is an estimate. Actual cost will vary. Other fees due (such as late fees) are not included in this estimate. Do not write out a check for this amount!

The yearly tag/registration renewal is based on a sliding scale but based on value of car.

Sales tax is 8.25% of total cost of vehicle to be collected before or at same time of initial registration.

Yep pretty darn expensive.....especially considering the yearly renewal is not cheap.

#54

Pro

#55

Le Mans Master

I live outside the city, in unincorporated King County. Other than electricity and gas we have nothing: no sewers, no streetlights, no sidewalks, and most certainly no bus or train access. Not for miles.

If I wanted to take an RTA ride I'd have to DRIVE THERE IN MY CAR to catch it.

And yet they ding each of my 10 vehicles with it. It truly blows. The formula is:

Current year - year of vehicle + 1 = years of service (value decreases each year in service)

Original MSRP x depreciated percentage = Depreciated value (based on years in service)

Depreciated value x 1.1% (current RTA rate) = RTA amount due

It just cost me an extra $120 or so on a 1969 Pontiac, about $500 on a 2010 Range Rover. It adds up!

Last edited by davepl; 02-07-2018 at 02:41 PM.

#56

Moderator

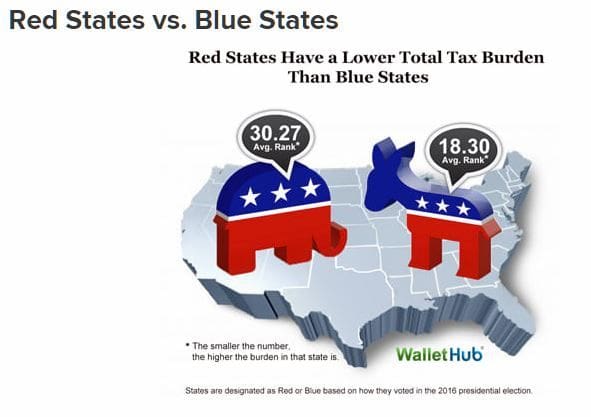

For the one comment about what the difference between red and blue states, it looks like they can both cost a lot. So I don't think it's a, who you voted, for issue.

But "car use" tax is not the entire story. Yes some states charge more for cars with fees such as a personal property tax, SC, Va... But they might have lower sales taxes, or real property taxes, or no income taxes. Other states my charge very little, but have higher gas taxes, income taxes, liquor tax, or require vehicle inspections.

I'd bet that if you total everything up, there isn't a lot of difference, it's just what you have to pay for the services you expect, and get.

But "car use" tax is not the entire story. Yes some states charge more for cars with fees such as a personal property tax, SC, Va... But they might have lower sales taxes, or real property taxes, or no income taxes. Other states my charge very little, but have higher gas taxes, income taxes, liquor tax, or require vehicle inspections.

I'd bet that if you total everything up, there isn't a lot of difference, it's just what you have to pay for the services you expect, and get.

#58

Burning Brakes

Member Since: Jan 2014

Location: Colorado Springs, CO/Augusta,GA Colorado

Posts: 1,178

Received 211 Likes

on

157 Posts

That $3000 vehicle sales tax was in addition to the normal GA State Sales tax of 8%?

Just bought a 2016 Stingray. $3000 sales tax based upon a GA computed value and an $18 or so title fee. Free GA Vet tag in future, as well as free Vietnam Nam and Army retired plates on other vehicles. Ga recently dropped annual ad valorum in favor of one time sales, but on ALL veh saless new and used.

#59

Melting Slicks

As mentioned earlier,in SC I paid the $300 sales tax and $24 to transfer tag from other Corvette(sold).

With a new tag,you pay the prop tax and then the new tag fee.

\db2

With a new tag,you pay the prop tax and then the new tag fee.

\db2

#60

Drifting

Member Since: May 2002

Location: Great State Of Arkansas

Posts: 1,520

Received 267 Likes

on

134 Posts

In Arkansas we do not have any vehicle inspection costs or have to pay a wheel tax or anything like that. However, our vehicles are considered “Personal Property”. Therefore we have to pay a Personal Property Tax every year. My annual registration fee is $3.89 a year for the tags then later in the year I pay $425 in Personal Property Tax on the 2017 Grand Sport. More than some and less than others! Oh, we do have a state 6.5% one time Sales tax on most things we buy.

Last edited by Apocolips; 02-07-2018 at 04:25 PM.