Out of state dealer normal to send paperwork only after receiving down payment?

#41

We don't take credit card deposits so we've never had the problem. I have seen other dealers get audited over it and its also a problem if the car get repossessed. The dealer could actually lose his ability to do loan paperwork at the dealership so I've never understood why so many take the risk.

Dave

Dave

...

Last edited by Skid Row Joe; 03-07-2019 at 07:14 PM.

#42

Race Director

A large majority of dealers in the U.S. do take credit cards to hold cars and do use those funds applied to the purchase if the customer wishes. There are several caveats that theoretically can come into play when a credit card is used depending on how much of the purchase price is charged. This is why most dealers place a limit on the amount that can be used and that amount usually runs between $2,000-5,000. Make no mistake, it is also a form of expense control because no dealer wishes to add 1.5-3% to their sales costs.

Being a primary lender to large dealers or dealer groups means buying a hundred or more loans monthly in many cases, floor-planning new and or used cars, and often other business relationships amounting to millions of dollars yearly. It is a highly competitive industry in most business climates and a valued relationship. It would certainly be counterproductive and somewhat stupid to accuse a dealer of bank fraud when they took a $2,000 deposit and downpayment on a $50,000 vehicle purchase. That is especially true when the customer could easily walk to the nearest bank and get that kind of advance on the same card.

Being a primary lender to large dealers or dealer groups means buying a hundred or more loans monthly in many cases, floor-planning new and or used cars, and often other business relationships amounting to millions of dollars yearly. It is a highly competitive industry in most business climates and a valued relationship. It would certainly be counterproductive and somewhat stupid to accuse a dealer of bank fraud when they took a $2,000 deposit and downpayment on a $50,000 vehicle purchase. That is especially true when the customer could easily walk to the nearest bank and get that kind of advance on the same card.

#43

It wouldn't be the lender making the accusation. It would be an FBI agent investigating the insolvency and subsequent bankruptcy of the lender. The kerbeck guy has a real point, and although its pretty unlikely to be a problem, if it is a problem then it will be a big one.

#44

Race Director

Really? Come on! By far the majority of the dealers in the U.S. take credit cards as deposits or some small percentage of payment. Would some of you people with all the answers please tell me ONE dealer now serving time or even charged with bank fraud because they took a $2,000 credit card payment? Hasn't happened and isn't going to happen. It is one of those stories you tell your people that sounds logical and saves money! The biggest chains in the country take credit card deposits daily.

You sound exactly like a mortgage broker in 2007, but they sure don't talk like that anymore.

Last edited by PatternDayTrader; 03-07-2019 at 07:02 PM.

#45

Your right I did miss the point because there is no point. The FBI is not going to come calling because the lender going broke is not going to be because the dealer took a credit card as a partial payment. The whole premise is total BS.

#46

Race Director

For your own sake it better stay that way.

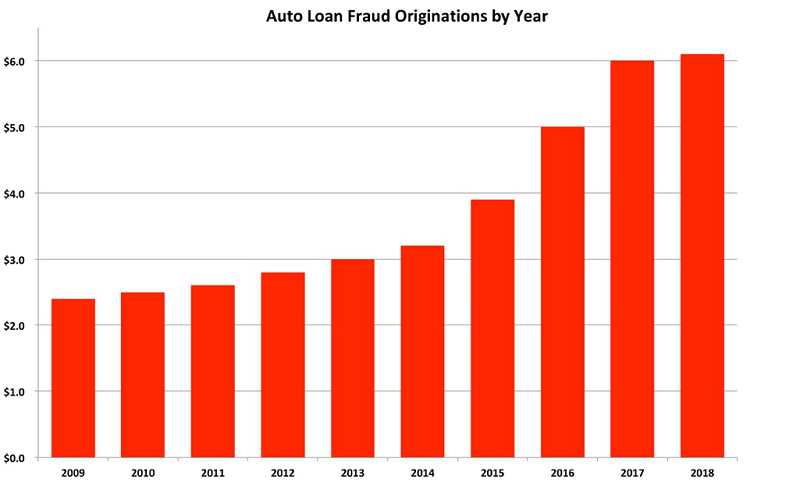

The 6.0 you see on the Y axis means six billion.

Last edited by PatternDayTrader; 03-07-2019 at 07:24 PM.

#47

Race Director

On May 28, 2015, the Associated Press reported that a federal judge sentenced former Serra Nissan General Sales Manager Abdul Islam Mughal to two and a half years in prison on two counts of fraud. Mughal pled guilty to the fraud charges in the scheme that involved falsifying documents that allowed customers who did not qualify for a loan to get a loan. The scheme elevated to bank fraud when the phony documents were presented to banks and other lenders.

Additional sentencing hearings are scheduled through July 2015 for the remaining defendants, and a restitution hearing is set for July 2. Restitution will be based on the amount of losses banks incurred as a result of the fraud.

This isn’t an isolated case. As the New York Times brought to light via AL.com, just last year, hundreds of fraudulent loans worth millions of dollars were found by federal authorities at other dealerships around the nation.

Last edited by PatternDayTrader; 03-07-2019 at 07:41 PM.

#48

Intermediate

Thread Starter

Interesting points about the CC deposit. In this case though I'm not getting financing through the dealer so I can't imagine why it would affect anything for them. It's simply one form of payment that goes towards a small percentage (<5%) of the total purchase price. A certified check from my bank and a check from my credit union cover the remainder.

I can't imagine my credit union would care either. Spending $3K on my CC on the deposit is no different from simply using my credit card to pay for a couch or booking a vacation after getting the loan.

I can't imagine my credit union would care either. Spending $3K on my CC on the deposit is no different from simply using my credit card to pay for a couch or booking a vacation after getting the loan.

#49

From where you and I sit as buyers, the more they put on my CC, the better! More Southwest Airlines miles for me. I was a 100% ca$h new C7 buyer, so it didn't matter whatsoever to me. Hell, I'd of put the entire $70K ALL on my credit card!

Hell, I'd of put the entire $70K ALL on my credit card!

Hell, I'd of put the entire $70K ALL on my credit card!

Hell, I'd of put the entire $70K ALL on my credit card!

#50

Yeah Jallen, exactly like I thought. You are just making bs up and have no idea what the true facts are.

On May 28, 2015, the Associated Press reported that a federal judge sentenced former Serra Nissan General Sales Manager Abdul Islam Mughal to two and a half years in prison on two counts of fraud. Mughal pled guilty to the fraud charges in the scheme that involved falsifying documents that allowed customers who did not qualify for a loan to get a loan. The scheme elevated to bank fraud when the phony documents were presented to banks and other lenders.

Additional sentencing hearings are scheduled through July 2015 for the remaining defendants, and a restitution hearing is set for July 2. Restitution will be based on the amount of losses banks incurred as a result of the fraud.

This isnt an isolated case. As the New York Times brought to light via AL.com, just last year, hundreds of fraudulent loans worth millions of dollars were found by federal authorities at other dealerships around the nation.

On May 28, 2015, the Associated Press reported that a federal judge sentenced former Serra Nissan General Sales Manager Abdul Islam Mughal to two and a half years in prison on two counts of fraud. Mughal pled guilty to the fraud charges in the scheme that involved falsifying documents that allowed customers who did not qualify for a loan to get a loan. The scheme elevated to bank fraud when the phony documents were presented to banks and other lenders.

Additional sentencing hearings are scheduled through July 2015 for the remaining defendants, and a restitution hearing is set for July 2. Restitution will be based on the amount of losses banks incurred as a result of the fraud.

This isnt an isolated case. As the New York Times brought to light via AL.com, just last year, hundreds of fraudulent loans worth millions of dollars were found by federal authorities at other dealerships around the nation.

You evidently translated my statements to somehow reflect my believing there is no such thing as fraud connected to auto loans or other bank loans. Of course there are frauds attached to auto loans and people have been being convicted of these actions since the retail auto industry began.

My original point is clear and unchallenged. Dealerships and their employees are not being charged with "bank fraud" for accepting credit card deposits or using small amounts as partial payment. Other crimes being perpetrated are an entirely different discussion.

#51

Race Director

The original statement by Kerbeck (post #34) was that putting part of the purchase on a credit card was "bank fraud". My subsequent posts were in discussion of the basic fallacy of this statement and the well documented use of credit card deposits by a majority of dealers.

You evidently translated my statements to somehow reflect my believing there is no such thing as fraud connected to auto loans or other bank loans. Of course there are frauds attached to auto loans and people have been being convicted of these actions since the retail auto industry began.

My original point is clear and unchallenged. Dealerships and their employees are not being charged with "bank fraud" for accepting credit card deposits or using small amounts as partial payment. Other crimes being perpetrated are an entirely different discussion.

You evidently translated my statements to somehow reflect my believing there is no such thing as fraud connected to auto loans or other bank loans. Of course there are frauds attached to auto loans and people have been being convicted of these actions since the retail auto industry began.

My original point is clear and unchallenged. Dealerships and their employees are not being charged with "bank fraud" for accepting credit card deposits or using small amounts as partial payment. Other crimes being perpetrated are an entirely different discussion.

#52

Nonsense. Dealers are prosecuted for bank fraud regularly. The credit card issue seems to be one variation of fraud. Only a complete moron would pretend that some variations of fraud, are not fraud. Kerbeck should be applauded for following the rules however inconvenient they may be.

I am done with the discussion since it is unrewarding to spar with someone who unfortunately does not have a basis of knowledge in the subject matter. Go buy a dealership, sign a few agreements, and operate for a few years... then come back for an adult like conversation.

#53

Platinum Supporting Dealership

The original statement by Kerbeck (post #34) was that putting part of the purchase on a credit card was "bank fraud". My subsequent posts were in discussion of the basic fallacy of this statement and the well documented use of credit card deposits by a majority of dealers.

You evidently translated my statements to somehow reflect my believing there is no such thing as fraud connected to auto loans or other bank loans. Of course there are frauds attached to auto loans and people have been being convicted of these actions since the retail auto industry began.

My original point is clear and unchallenged. Dealerships and their employees are not being charged with "bank fraud" for accepting credit card deposits or using small amounts as partial payment. Other crimes being perpetrated are an entirely different discussion.

You evidently translated my statements to somehow reflect my believing there is no such thing as fraud connected to auto loans or other bank loans. Of course there are frauds attached to auto loans and people have been being convicted of these actions since the retail auto industry began.

My original point is clear and unchallenged. Dealerships and their employees are not being charged with "bank fraud" for accepting credit card deposits or using small amounts as partial payment. Other crimes being perpetrated are an entirely different discussion.

Dave

The following users liked this post:

BEAR-AvHistory (03-08-2019)

#54

Race Director

Again you fail to acknowledge the facts presented. It is not fraud to accept a credit card and we all know that. At best what Kerbeck states to have any semblance of truth would be a clause in his dealer agreement with all his lenders stating they do not allow this practice. Even then it is far from bank fraud but rather a violation of the agreement or contract.

I am done with the discussion since it is unrewarding to spar with someone who unfortunately does not have a basis of knowledge in the subject matter. Go buy a dealership, sign a few agreements, and operate for a few years... then come back for an adult like conversation.

I am done with the discussion since it is unrewarding to spar with someone who unfortunately does not have a basis of knowledge in the subject matter. Go buy a dealership, sign a few agreements, and operate for a few years... then come back for an adult like conversation.

By the way, my real estate syndicate makes your dealership look puny in comparison.

#55

Platinum Supporting Dealership

Dave

#56

Race Director

I'm sure it does but the point is still the same. If your client is buying a $100,000 house and puts on the mortgage application that they are putting $10,000 down then they can not use a credit card. They can't do 100% financing when they are telling the mortgage company they are only doing 90% financing. Maybe your giant mortgage company is willing to violate banking rules but my puny dealership isn't.

Dave

Dave

Last edited by PatternDayTrader; 03-08-2019 at 10:50 AM.

The following users liked this post:

BEAR-AvHistory (03-08-2019)

#57

Platinum Supporting Dealership

So you are clear here Dave. I'm on your side with this. The post of mine you quoted was directed at Jallen. Borrowing the down payment and creating your own 100% financing, while telling the lender something different is fraud. This isn't even a complicated concept. I have no idea on earth why Jallen is taking the position he is taking.

Dave

#59

Normally, they are not charged with fraud unless it's a huge case. Normally, if the bank audit finds the problem, the dealer is given the opportunity to fix the situation and pay a fine. It happens for many different things, not just the credit card. And as far as bank fraud, it's a federal banking thing. It's clear that if you fill out a credit app for a personal loan, car loan, or mortgage and you say you are putting X down, that X must be cash and not borrowed and putting it on a credit card is borrowing. Just because many dealers are doing it and many are not being charged does not mean it's against banking regulations and we are not willing to violate the banking regulations. And, it's not about saving money. We do accept credit cards for parts and service and if someone buying a car wants to add some accessories or a warranty, they can put it on their card if those add ons are not part of the loan.

Dave

Dave

I can only assume you think the mega dealers such as AutoNation, Hendricks, and us other mere mortal dealers are all idiots because we take deposits and partial downpayments on credit cards...or natural born crooks. You also must think the lenders these folks use are also fools for not knowing what is going on and they are living in a vacuum. Since you also contend it is a Federal Banking Regulation, it would seem to mean that the lender could not waive the "fraud" even when the dealer discloses the credit card use during the approval process which many do.

It is amazing that a relatively small dealership group in the East is one of the few enlightened while the big dealer groups and major lenders are either defrauding or being defrauded daily. These are folks that hire attorneys like mere mortals hire lot boys. But, all of this can easily be cleared up. Please post a link to the Federal Bank Regulation that defines where using a credit card deposit as a partial downpayment is "bank fraud"... even when disclosed!

#60

Safety Car

Read this thread. This guy recently registered his ZR1 bought from McMulkin. He lists all the work he had to do. And how they helped him.

https://www.corvetteforum.com/forums...alifornia.html

Sorry I meant to post this in your other thread, OP.

https://www.corvetteforum.com/forums...alifornia.html

Sorry I meant to post this in your other thread, OP.

Last edited by pkincy; 03-08-2019 at 07:01 PM.